The law applies to both medical and dental coverage. Our attorneys can evaluate your individual circumstances and help you identify the insurance coverage option that is best for you.

Divorce Doesn’t Have To Cost You A Fortune In Santa

Whether or not you can keep your health insurance after the divorce will depend on two factors, one of which is in your control and one of which is not.

Court-ordered health insurance after divorce massachusetts. If you are currently on your spouse's health insurance, then they are required by the rule 411 automatic restraining order to maintain you on your health insurance during the pendency of the. Our legal team can help deal with health insurance after divorce. Below are a few options you may have for health insurance after divorce:

Divorce can leave you without your spouse’s company health insurance plan. However, you will be eligible for cobra health insurance coverage for up to 18 or 36 months (depending on the circumstances), just like any employee who loses coverage. Once that runs out, you would need to find another health insurance plan.

However, it is easy to obtain health insurance today, especially when children are involved. Health insurance providers consider a divorce a qualifying life event that makes you eligible for a special enrollment period. Then trust that you are in good hands.

Your health is the most important asset you have, and health insurance coverage is a close second. For example, in pernick v.brandt, 201 mich. For more information on court ordered health insurance, see rcw 26.09.105 and rcw 26.18.

( rsa 415:18, vii b) effective january 1, 2008 allows a former spouse continued coverage on the subscriber employee’s group health insurance policy for up to three years following the final decree of divorce. When your spouse is the one providing healthcare during the marriage for a spouse and family members, one of the most unsettling things a spouse may have to face is the prospect of getting coverage. After a divorce, you can continue under your husband's policy under cobra for 36 months.

Loss of health insurance after a divorce. The employers of the two persons are not parties to the lawsuit. Do you have child support health insurance questions or concerns?

175, § 110], i.e., a policy regulated by massachusetts (delivered or issued for delivery in the commonwealth), would (unless the divorce judgment specified otherwise. In general, the issue of continuing health insurance after a judgment of divorce is entered is addressed by federal legislation titled the consolidated omnibus budget reconciliation act (cobra). The thought of losing your health insurance due to a divorce can be stressful.

Divorce proceedings are between the two married persons seeking to end their marriage. During a divorce, the question arises as to how the other spouse, and children, will be covered by medical insurance. If you need help understanding a child support court order or preparing for a child support hearing, consult an experienced divorce attorney at integrative family law in seattle.

It is very important that there is no gap in coverage, so you must deal … maintaining your health insurance after divorce read more » You will have to pay the costs of the premiums, but will able to continue the insurance under his plan at the costs your employer gets it at. 175, § 110i, provided that the former dependent spouse of a member of a health insurance policy provided for in [g.

If your health insurance is through your spouse’s employer, once the divorce is final you will need to obtain health insurance for yourself. 293, 506 n.w.2d 243 (1993), a divorce decree obligated the husband to maintain $50,000 in life insurance and to name his wife the beneficiary of the policy.at the time of the divorce, the husband did not own any life insurance. Cobra requires that individuals that lose their health insurance are entitled to continue to be covered under that health.

However, this only applies to insured plans. After you get divorced, you may be able to temporarily keep your health coverage through a law known as cobra. if your former spouse got insurance through an employer that has at least 20. Divorce changes your legal status, and you may lose health insurance benefits because you are no longer married.

I think this is a bad idea and i counsel clients frequently and making sure that they have a proper plan in place as far as how to. The husband initially complied with the decree by obtaining a $50,000 policy. New hampshire laws on continued health care coverage after divorce.

If you don’t have health insurance after a divorce, here are some options for coverage. Under the health law, insurers must offer to cover young adults up to age 26, but parents aren't obligated to provide it, says timothy jost, a law professor at washington and lee university and an. Your right to receive health insurance through your partner’s plan is frequently based on your marital status.

It is essential that prior to the end of your divorce that you have a good idea of what your plan will be as far as health insurance for yourself and your children. Based on your individual needs, true blue compares the policies and rates of hundreds of different insurance companies to find your best solution.

There are nearly 200 Alaska Native Village Corporations

Mass Appeal Child custody and visitation Child custody

60 CrazyEasy Health Tips Your Body is Begging You to

Breach of parenting orders court Orders Parenting

Boston EMS Season 2 Episode 5 Boston ems, Polo ralph

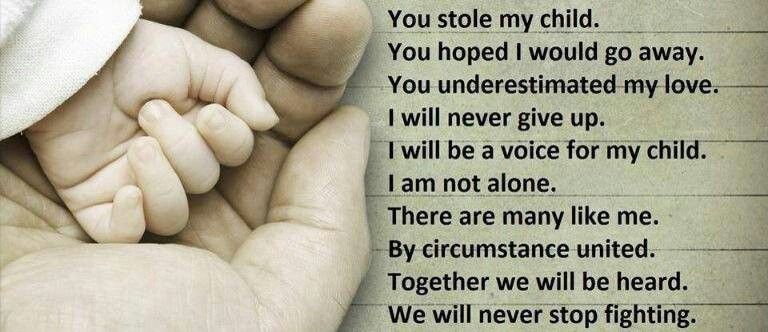

You stole my children Parental alienation, My children

Pin on Alzheimer's/Dementia/Age related decline

Which country do you think has the highest paid lawyers

You stole my children Parental alienation, My children

This is a Virginia form that can be used for Civil within

Dominic Levent Solicitors are seeking a specialist family

Apple, Ordered to Pay 1.1 Billion to Caltech for

Acknowledgement By Counsel Of Notice And Orders

WHY FAMILY LAWYERS ARE SO IMPORTANT